Recent

Recent

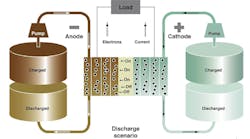

Energy Storage

Disrupting Energy Storage

April 25, 2024

Top Stories

Top Stories

Recommended

Recommended

Podcasts

Line Life Podcasts

Jan. 18, 2024

Members Only Content

Home

Fiber: The Key to Unlocking Tomorrow’s Energy Grid

April 24, 2024

Wildfire

Utility Investment In Forest Restoration

April 18, 2024

Smart Grid

Reimagining The Future Grid

April 17, 2024

Home

The Macro-Impact of the Microgrid

April 24, 2024

Sponsored Content

Sponsored Content

Renewables

Battery Energy Storage Systems | QuickChat

April 18, 2024

Renewables

Aerial Spacer Cable in Renewables Applications

March 27, 2024

Sponsored Content

Jobs

Jobs